Overview

In the Fall of 2021, CommerceHealthcare® sponsored a focused survey conducted by the Health Management Academy (HMA), an organization for executives from the nation’s top health systems and leading companies. The HMA survey involved both quantitative polling and in-depth telephone interviews to explore current issues in patient financial experience.

Key characteristics of the respondent profile included:

- Finance and revenue cycle management (RCM) executives from director to C-level.

- Representation from 13 unique health systems that own or operate a total of 196 hospitals.

- Aggregate volume of 1.6 million inpatient and 32 million outpatient admissions annually.

- Average operating revenue of $5.7 billion, with 38% from large health systems (greater than $6 billion), 15% medium ($4-6 billion), and 46% small (under $4 billion).

Combining the findings of this survey with relevant independent data, CommerceHealthcare® has produced a three-part series of briefs titled Perspectives on Patient Financial Experience. This second report explores the current status of patient financing programs and recommendations to expand their uptake for improved patient financial experience.

Continuing need for financing

The first paper in this series, Rising Patient Payment Obligation, documented the growth in patient responsibility for healthcare expenses. The report showed that payment difficulties beset a wide range of individuals, including the insured. A recent study added corroboration, finding that 51% of households in which everyone has insurance still had out-of-pocket medical costs, with 19% in excess of $1,500.1

Extent of provider financing programs

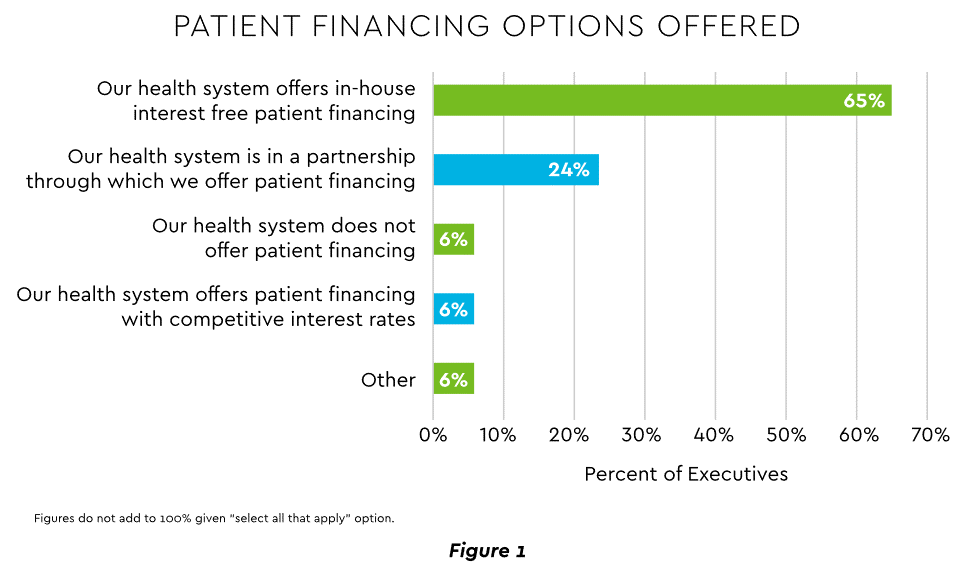

Today most health systems, hospitals and practices offer some financial help to patients in need. Among the health systems surveyed by HMA, two-thirds issue their own no-interest loans. Nearly a quarter have joined with a financial institution to offer financing (Figure 1).

View PDF of Figure 1 chart[PDF]

Provider programs are variable in scope and structure. Many struggle to offer no- or low-interest with extended terms, a challenge heightened by the financial burdens created by the pandemic. Some providers maintain relatively informal programs. A quote from an executive in the HMA survey directly expresses the potential downside: “One of the items our health system doesn’t have today is a formal loan program for our patients. We have historically managed that in-house, but inconsistently, so we are currently looking for an external loan vendor.”

Underutilization seen in patient financing use

Not all patients who are likely candidates avail themselves of financing. The HMA survey measured patient adoption rates and uncovered significant provider variation. The average was just 19%, and the highest reported level was 60%. However, two distinct provider segments were evident. One group had high adoption (40%+), while the other experienced minimal adoption (5% or less).

A pre-pandemic independent survey provided further detail on usage. Of patients incurring out-of-pocket expenses for inpatient or emergency room care, 44% selected a payment plan.2

Adoption was 39% for expenses ranging from $50-$250 and 51% when the amount reached $1,000. Several implications flow from this data. First, patient financing interest begins at relatively small dollar amounts. Second, while no one expects 100% adoption, the fact that only half opted in for obligations over $1,000 seems less than optimal.

Recommendations

Expanded financing programs would benefit patients and providers alike. Four actionable strategies to achieve such expansion emerged from the HMA survey.

Maximize convenience

Removing friction from the process to obtain financing helps alleviate patient anxiety. A convenient experience smooths the path to adoption for many.

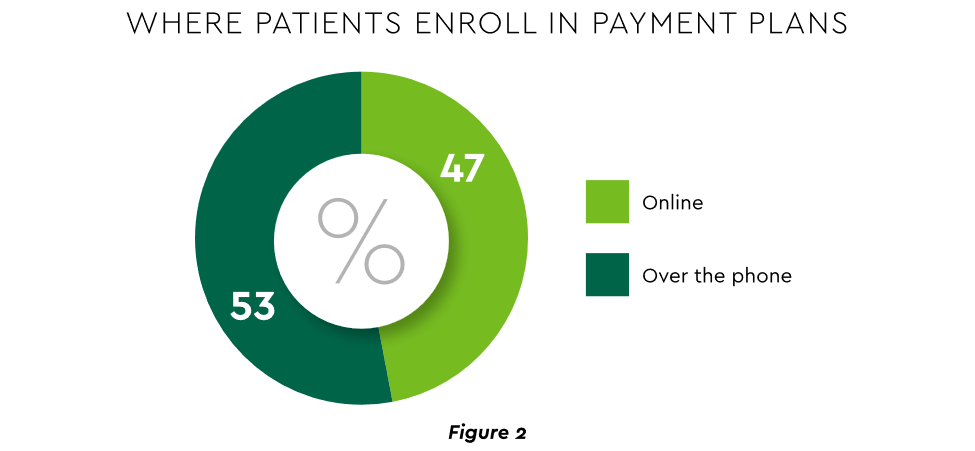

One key convenience is online self-enrollment. The HMA survey found that almost half of patients are now using this method (Figure 2). Online portals also facilitate easy bill payment.

View PDF of Figure 2 chart[PDF]

Adopting these measures generates benefits beyond encouraging more adoption by patients:

- Overall patient satisfaction. An independent study identified 41% of consumers naming “convenient billing/payment options” as a factor influencing their loyalty to a provider.3

- Alignment with broader patient experience strategy. Healthcare organizations have been pursuing a “digital front door” strategy that uses online portals and other digital tools to guide patients conveniently through their healthcare journeys. A leading forecaster believes that by 2023, 65% of patients will access services through a digital front door.4

Offer flexibility

Flexible programs likewise promote patient participation by tailoring financing to individual needs. Financing duration is important. Based on its extensive experience, CommerceHealthcare® believes that keeping monthly payments under $200 is comfortable for most patients and maximizes loan compliance. Offering loans for up to five years enables capturing that “sweet spot.” Other desirable forms of flexibility include lines of credit that can expand to cover subsequent care expenses and financing based on pre-service estimates.

Educate and inform

Providers who have built successful programs almost universally underscore the need for constant patient education. Too many consumers remain unaware of the options, and patients have indicated that hospitals frequently are not proactive in offering plans.5 Among proven communications tactics:

- Use marketing tools. Brochures, email, website information — these and other marketing vehicles are effective at spreading the message. Consider multichannel communications to maximize reach.

- Maintain steady information flow. The HMA survey advises “discussing payment options with patients throughout the patient financial journey to make it as easy as possible to fulfill their financial obligation.”

- Extend outreach. Providers have seen success training and supplying marketing materials to intake staff in emergency departments, primary care clinics and other significant sources of admissions.

Rely on external financing

Deploying the strategies outlined in this paper can pose difficulties for many health systems, hospitals and practices. Their financial pressures often limit capability to support expansive financing. Most organizations are unable or unwilling to play the role of a bank. Staff shortages also hinder efforts in some cases.

An increasingly popular solution is to join with a well-resourced bank experienced in healthcare financing. As Figure 1 showed, 24% of HMA survey respondents said they have entered such an agreement. The survey also found that 60% of the health systems with above average patient adoption work with an outside financing vendor.

A strong bank can offer a range of payment plans while reducing administrative burdens. The HMA report observed that a “key strategic priority” for many health systems is to use a blended approach that keeps most short-term plans inhouse and offers robust extended-term options through external financial institutions.

External programs bring formal structure, replacing the often ad hoc and inconsistent monthly installment plans in use today. Consumers are comfortable dealing with a bank for loans and more likely to maintain compliance. The right vendor also delivers convenience, including hosting online portals for the provider when desirable.

Conclusion

Opportunity exists to use patient financing more effectively. Increasing patient adoption of financing plans is a prime target. This brief article aids understanding of the task and provides recommendations that can be implemented quickly. Taking these steps offers manifold benefits for all involved and contributes substantially to optimizing the patient financial experience.

CommerceHealthcare® solutions are provided by Commerce Bank.

Disclosures:

- Aflac, 2021 Aflac Health Care Issues Survey, December 2, 2021.

- A. Pecci, “Patients Want Payment Plans, Even for Small-Dollar Hospital Bills,” HealthLeaders, January 31, 2019.

- Press Ganey, Consumer Experience Trends in Healthcare, 2021.

- IDC, Futurescape: Worldwide Health Industry Predictions, 2021.

- Pecci, “Patients Want Payment Plans.”